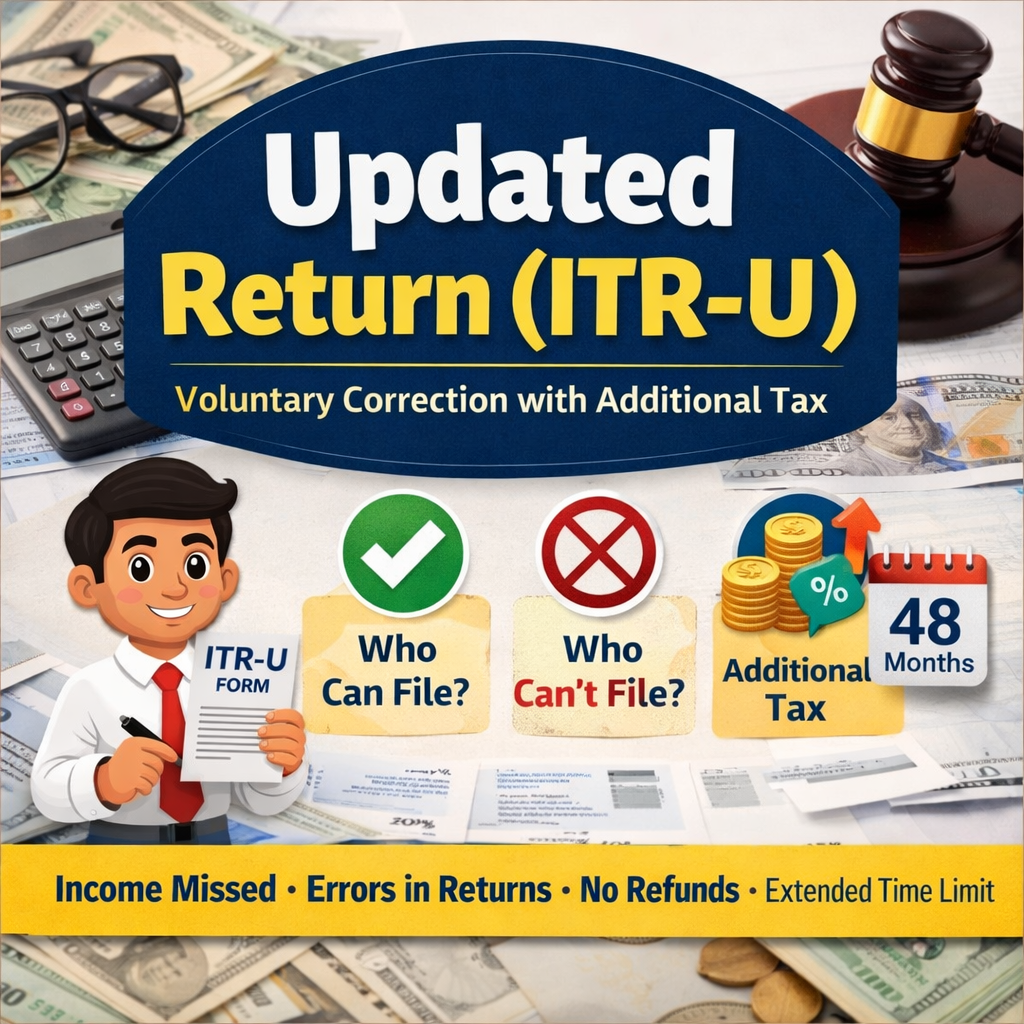

✅ Who is Eligible to File ITR-U? You may file an Updated Return if you need to: Report missed or under-reported income Correct wrong income details Amend an incorrect tax rate Reduce excess loss or depreciation claimed Update wrong deductions or exemptions File a return even if no return was filed earlier

Income-tax law ke andar voluntary compliance ko badhava dene ke liye Updated Return (ITR-U) ka concept laya gaya hai. Iska main objective ye hai ki agar kisi taxpayer se return file karte samay koi income reh gayi ho, galat details report ho gayi ho, ya return file hi nahi hui ho, to wo apni galti khud se sudhaar sake — bas shart ye hai ki uske saath due tax, interest aur additional tax ka payment kiya jaye.

Recent amendments ke baad ITR-U ki time limit aur additional tax structure dono me kaafi bade badlav kiye gaye hain. Is article me updated provisions ko simple language me samjhaya gaya hai.

ITR-U kya hota hai?

ITR-U (Updated Income-tax Return) ek special return hai jo Income-tax Act ke Section 139(8A) ke tahat file ki jaati hai. Ye tab file hoti hai jab:

-

Pehle file ki hui return me koi income disclose nahi hui ho

-

Income ya details galat report hui ho

-

Taxpayer ne pehle koi return file hi nahi ki ho

👉 Lekin dhyaan rahe, ITR-U sirf tab allowed hai jab usse extra tax payable banta ho.

Kaun ITR-U file kar sakta hai?

Neeche diye gaye taxpayers ITR-U file kar sakte hain:

-

Individual

-

HUF

-

Firm

-

Company

-

AOP / BOI

-

Trust ya anya entities

Aap ITR-U file kar sakte hain agar:

-

Aapne pehle original / belated / revised return file ki ho

-

Ya pehle return file nahi ki ho, lekin ab income disclose karne par tax payable ho raha ho

🔔 Important condition:

Updated return file karne ke baad tax liability increase honi chahiye. Agar tax nil ho ya refund ban raha ho, to ITR-U file nahi ki ja sakti.

Kaun ITR-U file nahi kar sakta?

Nimn situations me ITR-U file karna allowed nahi hai:

-

Agar updated return se:

-

Refund mil raha ho, ya

-

Pehle se due refund ki amount badh rahi ho

-

-

Agar updated return se:

-

Total tax liability kam ho rahi ho

-

-

Agar us assessment year ke liye:

-

Search u/s 132

-

Survey (specified cases)

-

Requisition u/s 132A

jaise proceedings start ho chuki ho

-

-

Agar taxpayer:

-

Carry forward loss ko increase karna chahta ho

(loss sirf reduce kiya ja sakta hai, badhaya nahi)

-

ITR-U file karne ki time limit (Updated Provision)

Purana rule:

ITR-U sirf 24 months ke andar file ki ja sakti thi.

Naya rule (1 April 2025 se effective):

Ab ITR-U 48 months (4 saal) tak file ki ja sakti hai, relevant assessment year ke end se.

Example:

-

Assessment Year: 2024-25

-

AY ka end: 31 March 2025

-

ITR-U ki last date: 31 March 2029

👉 Is extension ka purpose ye hai ki taxpayers ko zyada samay mile voluntarily income disclose karne ke liye.

ITR-U par Additional Tax (Section 140B)

ITR-U file karte waqt taxpayer ko ye payments karni hoti hain:

-

Applicable Income Tax

-

Interest (Section 234A / 234B / 234C, jo bhi apply ho)

-

Additional Income-tax

Additional tax ka calculation Tax + Interest ke total amount par hota hai.

Additional Tax Rates – Updated Structure

| ITR-U Filing Period | Additional Tax |

|---|---|

| 12 months ke andar | 25% |

| 12–24 months | 50% |

| 24–36 months | 60% |

| 36–48 months | 70% |

⏳ Delay jitna zyada, additional tax utna hi zyada — isliye early compliance financially faydemand hai.

Simple Example

Maan lijiye:

-

Additional tax payable: ₹1,00,000

-

Interest: ₹10,000

-

Total (Tax + Interest): ₹1,10,000

12 months ke andar filing:

-

Additional tax @25% = ₹27,500

-

Total payable = ₹1,37,500

3rd year me filing (24–36 months):

-

Additional tax @60% = ₹66,000

-

Total payable = ₹1,76,000

Important Practical Points

-

ITR-U ka use refund claim ke liye nahi ho sakta

-

Ye facility sirf voluntary disclosure ke liye hai

-

Interest calculation me chhoti si galti additional tax ko bhi badha sakti hai

-

Har assessment year ke liye sirf ek baar ITR-U file ki ja sakti hai

-

Hamesha correct ITR-U form aur latest utility ka hi use karein