Why 31 December Is So Important for Professionals and Businesses

31st December 2025 is far more than just the close of the calendar year.

It marks one of the most crucial compliance cut-off dates under GST, Income Tax, and MCA regulations for FY 2024-25 / AY 2025-26.

For Chartered Accountants, tax consultants, business owners, companies, and professionals, overlooking this deadline can lead to loss of refunds, late fees, penalties, and long-term litigation exposure.

Let us break down why this single date carries such immense importance.

🔴 1. Deadline for Filing GSTR-9 (GST Annual Return) – FY 2024-25

GSTR-9 is the annual GST return that provides a consolidated view of:

-

Outward supplies

-

Inward supplies

-

Input Tax Credit (ITC) claimed

-

Taxes paid

-

Year-end adjustments

Important points to note:

-

31st December 2025 is the statutory due date for filing GSTR-9 for FY 2024-25

-

Filing is optional for taxpayers with AATO up to ₹2 crore

-

Once submitted, GSTR-9 cannot be revised

This return plays a key role in:

-

GST scrutiny proceedings

-

Departmental notices

-

ITC verification and reconciliation

Who needs to be especially cautious?

-

Businesses with multiple amendments during the year

-

Taxpayers who rectified FY 2024-25 errors in FY 2025-26

-

Taxpayers facing ITC mismatches with GSTR-2B

🔴 2. Due Date for Filing GSTR-9C (GST Reconciliation Statement)

GSTR-9C is a reconciliation statement comparing:

-

Audited financial statements

-

GSTR-9 annual return

Key highlights:

-

Applicable to taxpayers whose turnover exceeds the prescribed audit limit

-

31st December 2025 is the final due date

-

Although now self-certified, it remains a high-risk compliance document

Any mismatch may trigger:

-

GST audits

-

Demand notices

-

Interest and penalty proceedings

🔴 3. Final Date to File Belated or Revised ITR – AY 2025-26

This is one of the most overlooked yet most critical year-end deadlines.

What closes on 31st December 2025?

-

Filing of Belated Income Tax Returns

-

Filing of Revised Income Tax Returns

Why this date is crucial:

-

It is the last chance for non-filers to submit their return

-

Errors in earlier returns can no longer be corrected after this date

-

Unclaimed income tax refunds may lapse permanently

Who should be extra alert?

-

Salaried individuals awaiting refunds

-

Professionals and freelancers with TDS deductions

-

Businesses that filed incorrect or incomplete returns earlier

-

Taxpayers who have received CPC intimations or mismatch notices

🔴 4. MCA Annual Compliance – Extended Due Date up to 31st December 2025

The Ministry of Corporate Affairs (MCA) has permitted companies to complete their annual compliance filings for FY 2024-25 on or before 31st December 2025.

Forms included:

-

AOC-4 – Filing of financial statements

-

MGT-7 / MGT-7A – Annual return

Why this deadline matters:

-

Filing within the extended timeline helps avoid substantial additional fees

-

Failure to comply may result in:

-

Monetary penalties on the company

-

Personal penalties on directors

-

Long-term risk of director disqualification

-

🔴 5. PAN–Aadhaar Linking – Practical Year-End Implications

While PAN–Aadhaar linking requirements differ based on taxpayer categories, 31st December 2025 effectively serves as a practical deadline to ensure:

-

Hassle-free income tax return filing

-

Timely processing of tax refunds

-

Prevention of PAN becoming inoperative for income tax purposes

Taxpayers with pending PAN–Aadhaar linkage issues frequently encounter:

-

Delays or blockage of refunds

-

Difficulties in filing returns

-

Increased scrutiny, notices, and compliance-related delays

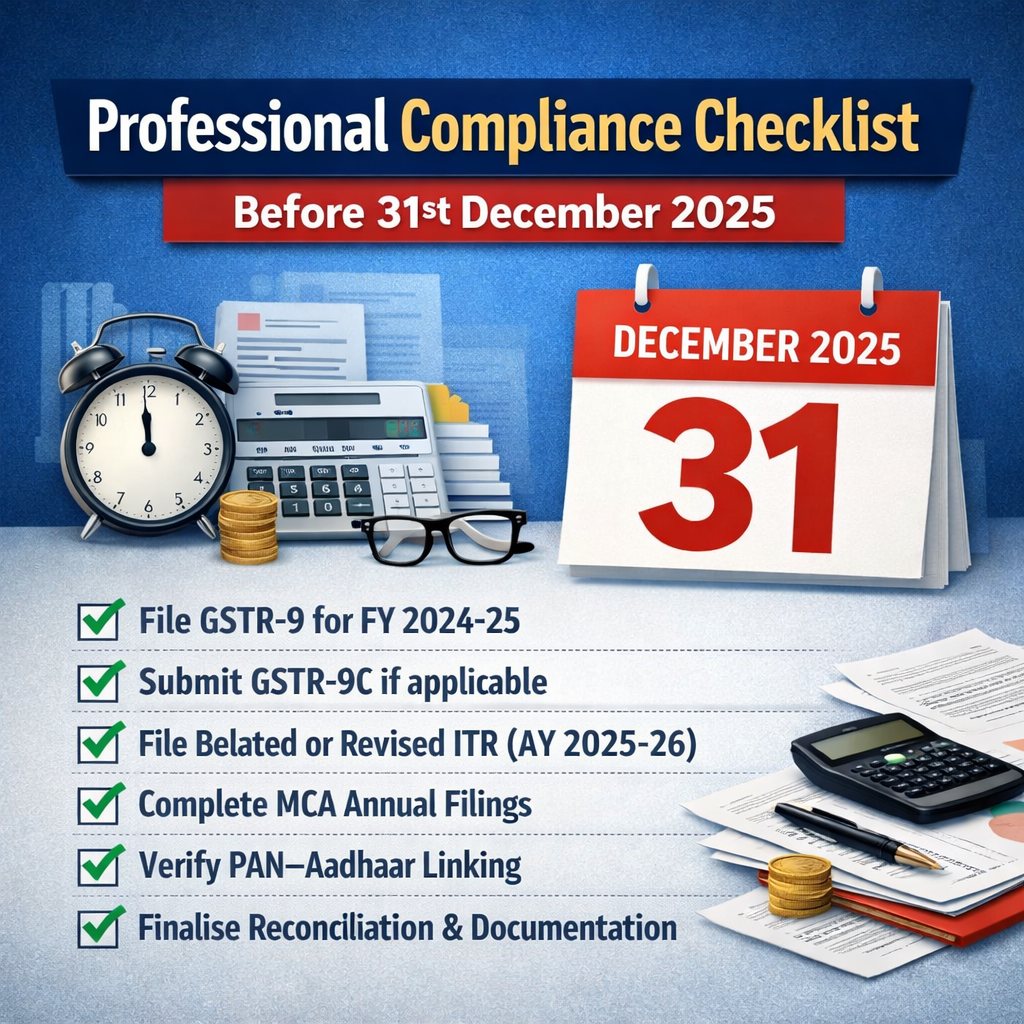

📌 Professional Compliance Checklist – Tasks to Complete Before 31st December 2025

✔ Ensure filing of GSTR-9 for FY 2024-25

✔ Submit GSTR-9C wherever reconciliation requirements apply

✔ File belated or revised Income Tax Returns for AY 2025-26

✔ Complete MCA annual compliances, including AOC-4 and MGT-7 / MGT-7A

✔ Confirm and regularise PAN–Aadhaar linkage status

✔ Finalise reconciliations, verifications, and supporting documentation

-