New Regulations for TDS Return Rectification Applicable from 01-04-2026

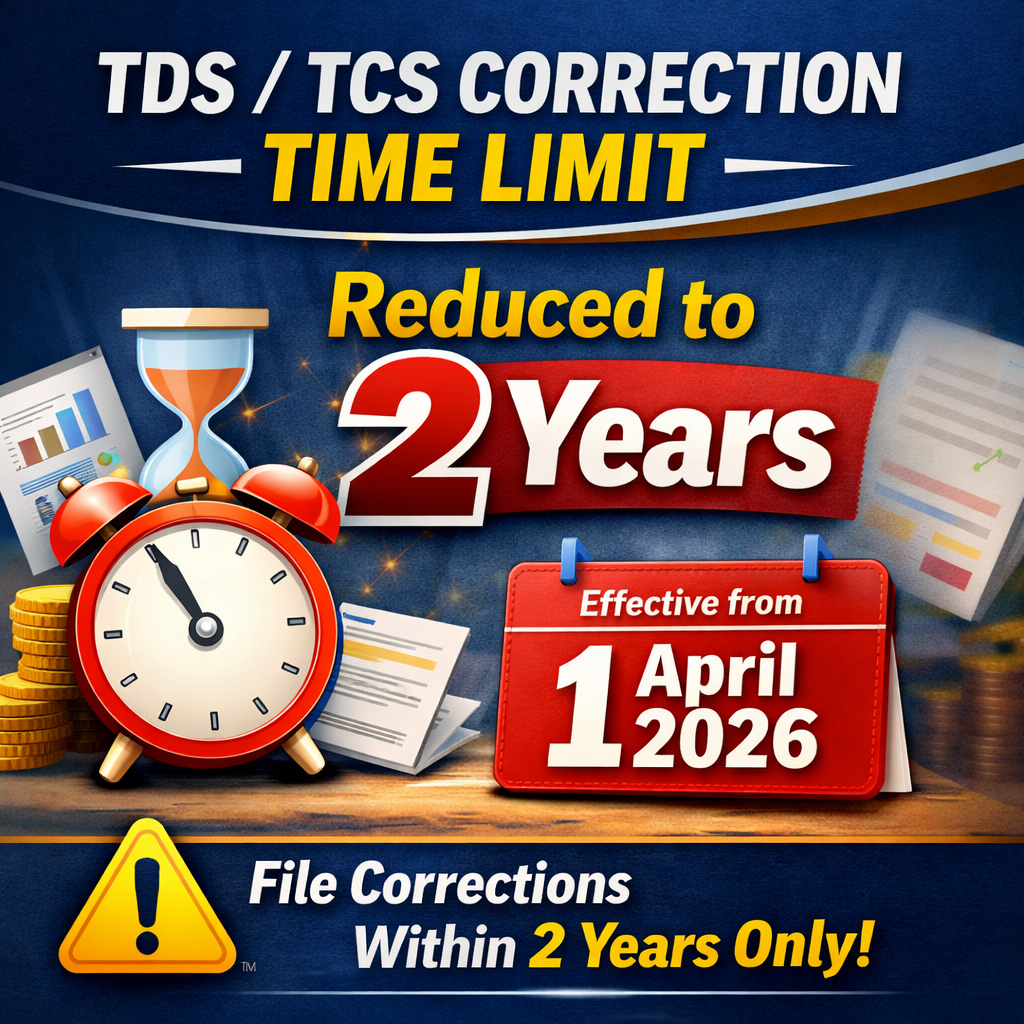

TDS / TCS Correction Statements: Time Limit Cut Down to 2 Years (Effective 01 April 2026)

🔔 What’s the Latest Change?

The Income Tax Department has introduced a major compliance reform by reducing the time limit for filing TDS and TCS correction statements to just 2 years, applicable from 1 April 2026.

Until now, deductors had the flexibility to revise old TDS/TCS returns even after many years. This long-standing practice will no longer be permitted.

⏳ Key Change Explained: Old Rule vs New Rule

🔙 Earlier Position (Before 01.04.2026)

-

No strict statutory deadline for filing correction statements

-

Corrections were practically allowed up to 7 years or more

-

Deductors commonly rectified:

-

Incorrect PAN details

-

Challan mapping errors

-

Short or excess deduction

-

Late reporting issues

-

-

Corrections were accepted even after several years

🔜 New Rule (From 01.04.2026)

-

⛔ Correction statements allowed only within 2 years

-

The 2-year period will be calculated from:

-

End of the relevant financial year

-

-

❌ No correction will be permitted beyond this period

-

This is a strict and absolute deadline, not extendable in any case

📅 Last Opportunity for Old TDS/TCS Periods

Correction statements for the following quarters will be allowed only up to 31 March 2026:

-

Q4 of FY 2018–19

-

Q1 to Q4 of FY 2019–20 to FY 2022–23

-

Q1 to Q3 of FY 2023–24

⚠️ From 1 April 2026 onwards, the TRACES portal will permanently block corrections for these periods.

❌ Impact of Missing the 2-Year Deadline

Failure to file corrections within the prescribed time may result in:

-

❌ Permanent denial of correction facility

-

❌ Loss of TDS/TCS credit for deductees in Form 26AS / AIS

-

❌ Disputes with employees, vendors, or contractors

-

❌ Penalties ranging from ₹10,000 to ₹1,00,000

-

❌ Higher compliance and audit risks

-

❌ Interest liability and possible disallowance of expenses

✅ Reason Behind This Amendment

The department aims to promote:

-

Timely reconciliation of data

-

Faster and accurate credit to deductees

-

Reduced backlog of old corrections

-

Lower litigation and disputes

-

A shift towards real-time, technology-driven compliance

This change reflects a move towards strict timelines and disciplined reporting.

🧾 Best Practices Suggested by the Department

-

Regularly use TRACES utilities and validation tools

-

Track defaults and mismatches frequently

-

File correction statements immediately upon detecting errors

-

Train staff on the revised timelines

-

Adopt a preventive compliance approach

📌 Action Checklist for Deductors & Tax Professionals

✔ Review all pending TDS/TCS correction requirements

✔ Resolve old mismatches before 31 March 2026

✔ Strengthen internal review and control systems

✔ Inform clients and staff about the 2-year non-negotiable limit