New Income Tax Slab Rates in Budget 2026: FY 2026-27 (AY 2027-28), ITR Deadlines & TDS/TCS Rules

Key Income Tax & ITR Updates – Budget 2026

-

No change in income tax slab rates under either tax regime.

-

Simplified ITR forms will be introduced shortly to ease compliance.

📅 Revised ITR Due Dates (Non-Audit Cases)

-

Business & Trust cases: Due date extended from 31 July to 31 August

-

Other non-audit cases: Due date continues to be 31 July

🔁 Revised Return – Section 139(5)

-

Time limit to file a revised return extended from 31 December to 31 March of the relevant assessment year.

🔄 TDS & TCS Updates

-

TDS and TCS rates rationalised to reduce complexity and mismatches.

🏠 Property Purchase from NRI – Key Relief

-

TAN requirement removed for buyers of property from an NRI.

-

A PAN-based challan system has been introduced for payment of TDS, simplifying the compliance process.

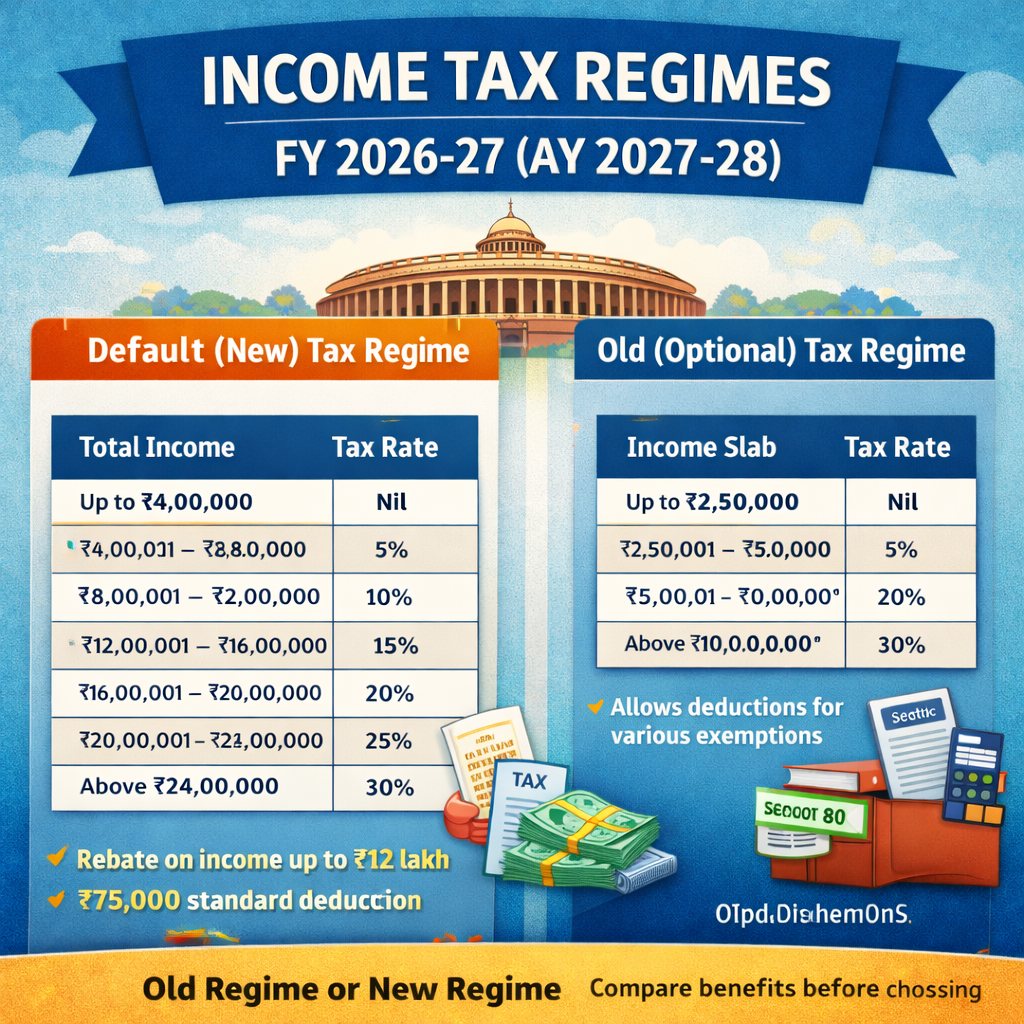

Income Tax Slab Rates – Default (New) Tax Regime

The following income tax slab rates will apply to individuals opting for the default new tax regime for FY 2026-27 (AY 2027-28):

Total Income Tax Rate Up to ₹4,00,000 Nil ₹4,00,001 – ₹8,00,000 5% ₹8,00,001 – ₹12,00,000 10% ₹12,00,001 – ₹16,00,000 15% ₹16,00,001 – ₹20,00,000 20% ₹20,00,001 – ₹24,00,000 25% Above ₹24,00,000 30% These slab rates apply uniformly to all individuals, including salaried taxpayers, with no age-based differentiation.

Key Features of the New Tax Regime

1️⃣ Rebate under Section 87A

Budget 2026 has enhanced tax relief through Section 87A:

-

Individuals with net taxable income up to ₹12,00,000 are eligible for a 100% tax rebate.

-

Consequently, the total tax liability becomes NIL for such taxpayers under the default regime.

-

This change significantly improves affordability for middle-income earners.

2️⃣ Standard Deduction for Salaried Taxpayers

-

Salaried individuals can claim a standard deduction of ₹75,000 under the new tax regime.

-

Because of this deduction, effective tax-free income can extend up to ₹12.75 lakh.

-

This makes the default regime even more beneficial for salaried employees.

Old Tax Regime (Optional)

The old tax regime continues as an optional choice and follows a different slab structure. It allows various deductions and exemptions, such as HRA, Section 80C, Section 80D, and others.

Income Tax Slabs under the Old Regime

Income Slab Tax Rate Up to ₹2,50,000 Nil ₹2,50,001 – ₹5,00,000 5% ₹5,00,001 – ₹10,00,000 20% Above ₹10,00,000 30% While deductions are permitted under the old regime, it does not provide the higher rebate threshold available under the new tax regime. As a result, it may be less beneficial for taxpayers with limited deductions.

Which Tax Regime Is Better for You?

-

Taxpayers with minimal deductions or exemptions may benefit more from the new default tax regime due to lower slab rates, higher rebate, and standard deduction.

-

Taxpayers who claim substantial deductions, such as housing loan interest, insurance premiums, and eligible investments, may still find the old regime more suitable.

-

It is advisable to perform a comparative tax calculation before choosing the appropriate regime.

-