January 2026: Complete Compliance & Filing Schedule for Businesses

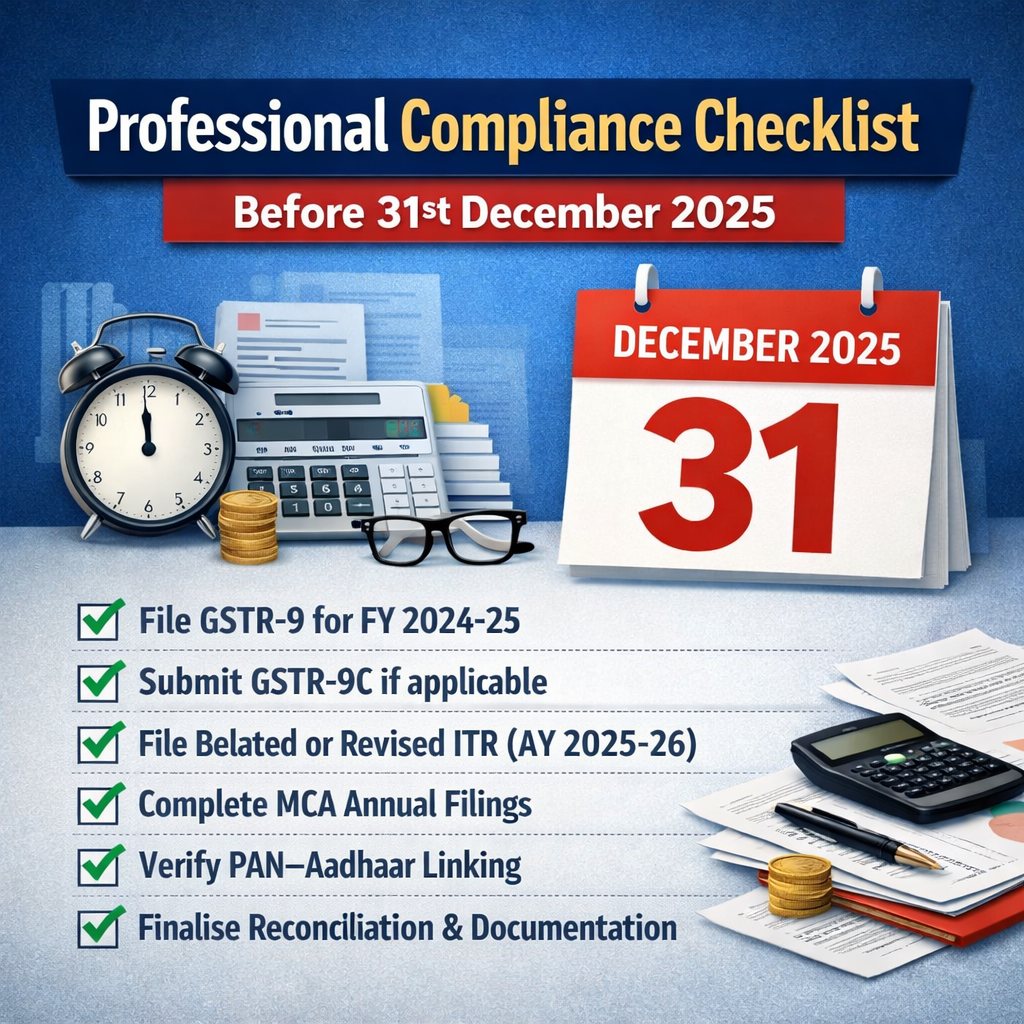

January marks more than just the start of a new calendar year—it is also one of the busiest compliance months for businesses, professionals, and employers. A tight cluster of statutory obligations such as GST returns, TDS filings, PF-ESI contributions, and MCA compliances leaves little room for error. Missing even one due date can trigger late fees, interest, penalties, or system-generated notices.

As we enter January 2026, the compliance environment continues to become more stringent, backed by tighter deadlines, automated checks, and enhanced portal validations. To help businesses, taxpayers, and professionals stay on track, this article provides a comprehensive, date-wise compliance calendar for January 2026, covering GST, Income Tax, TDS/TCS, PF, ESI, and MCA requirements—all consolidated in one place.

GST Compliance

Due Date | Return/Form | Period | Applicability

7 January 2026 | GSTR-7 | December 2025 | GST TDS deductors

7 January 2026 | GSTR-8 | December 2025 | E-commerce operators

11 January 2026 | GSTR-1 | December 2025 | Monthly outward supply filers

20 January 2026 | GSTR-3B | December 2025 | Monthly GST return

22/24 January 2026 | GSTR-3B (QRMP) | Oct–Dec 2025 | Based on state category

20 January 2026 | GSTR-5A | December 2025 | OIDAR service providers

GST Composition Scheme

18 January 2026 | CMP-08 | Oct–Dec 2025

TDS/TCS & Income-Tax Compliances

Monthly TDS/TCS Payment

7 January 2026 – Deposit of TDS/TCS for December 2025

(Generally payable by the 7th of the following month)

Quarterly TDS/TCS Returns

15 January 2026 | Form 27EQ (TCS) | Oct–Dec 2025

31 January 2026 | Forms 24Q, 26Q, 27Q | Oct–Dec 2025

Income-Tax Update

As per CBDT indications, new ITR forms and procedures under the simplified Income-tax framework are expected to be notified by January 2026, ahead of implementation from 1 April 2026.

PF & ESI Compliance

15 January 2026

• EPF contribution payment & return – December 2025

• ESI contribution payment & return – December 2025

(PF and ESI dues are generally payable by the 15th of the subsequent month.)

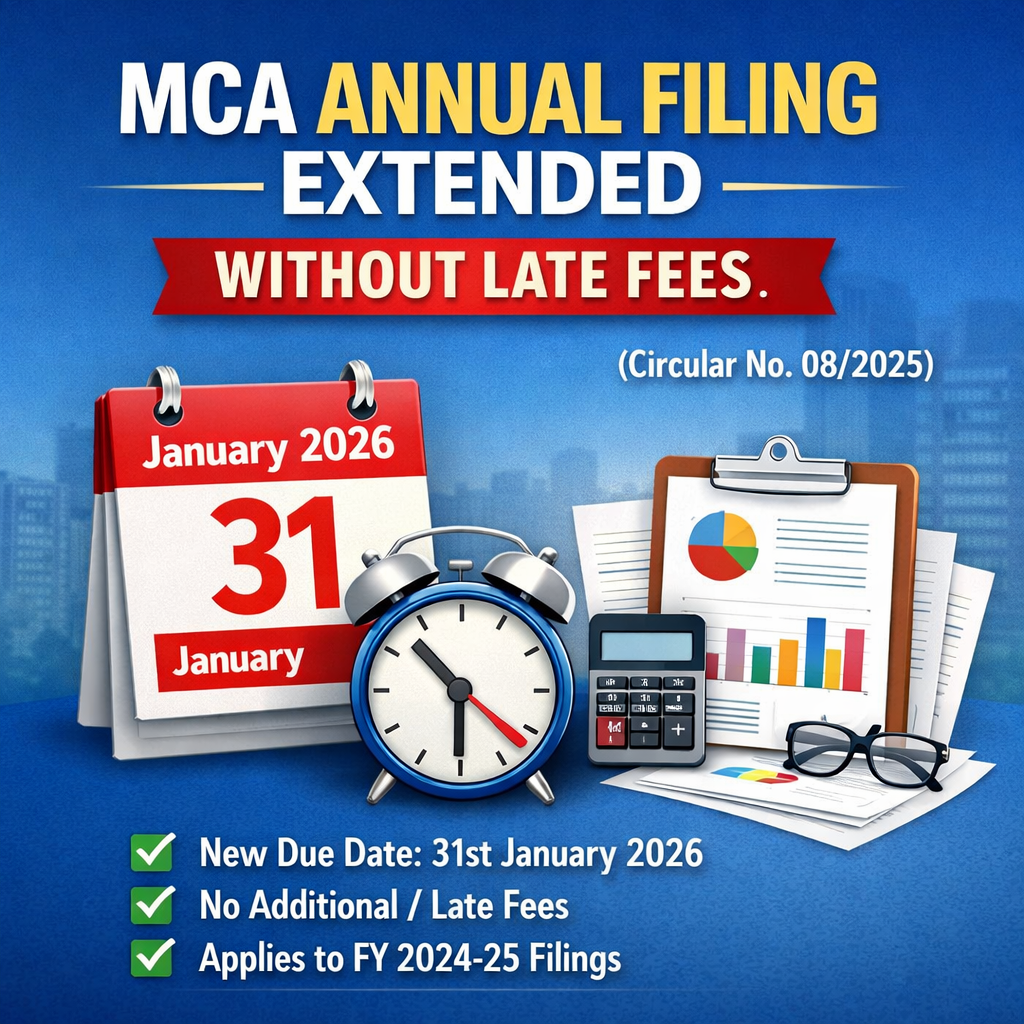

MCA / ROC Filings

31 January 2026

• Filing of Annual Returns and Financial Statements for FY 2024-25

• Ensure timely submission of AOC-4 and MGT-7 within the extended timeline

LLPs should also verify due dates for Form 11 and other applicable ROC filings based on entity-specific requirements.

Other Important Statutory Compliances

Professional Tax (PT)

Generally payable by 31 January 2026 for December 2025 salary deductions (state-specific rules apply).

Advance Tax

No advance tax installment is due in January; the next installment falls in March 2026.

Consequences of Delayed Compliance – Quick Snapshot

• GST: Late fees and interest on net tax liability

• TDS/TCS: Interest and penalties for late payment or return filing

• PF/ESI: Interest and statutory damages under respective laws

In today’s technology-driven compliance framework, delays rarely go unnoticed. GST filings, TDS payments, PF-ESI contributions, and MCA submissions are closely monitored through integrated systems. Timely compliance is no longer optional—it is essential.

Use this January 2026 Compliance Calendar as a ready reference, plan your filings in advance, and complete all obligations well before due dates. Staying proactive today helps avoid financial exposure, legal complications, and unnecessary stress in the future.