Top 10 Changes in GST & Income Tax Applicable from January 1, 2026

Important Tax Compliance Changes from 1 January 2026 – What Every Taxpayer Must Know

The commencement of 1 January 2026 brings significant compliance implications under GST and Income Tax laws in India. Multiple statutory deadlines expire on 31 December 2025, after which several system-driven restrictions, penalties, and consequences automatically come into force.

Failure to act before these cut-off dates may lead to late fees, interest liabilities, denial of Input Tax Credit (ITC), inoperative PAN, suspension of GST registration, and increased tax burden.

This article outlines the key changes effective from 1 January 2026, including several often overlooked but high-risk compliance areas.

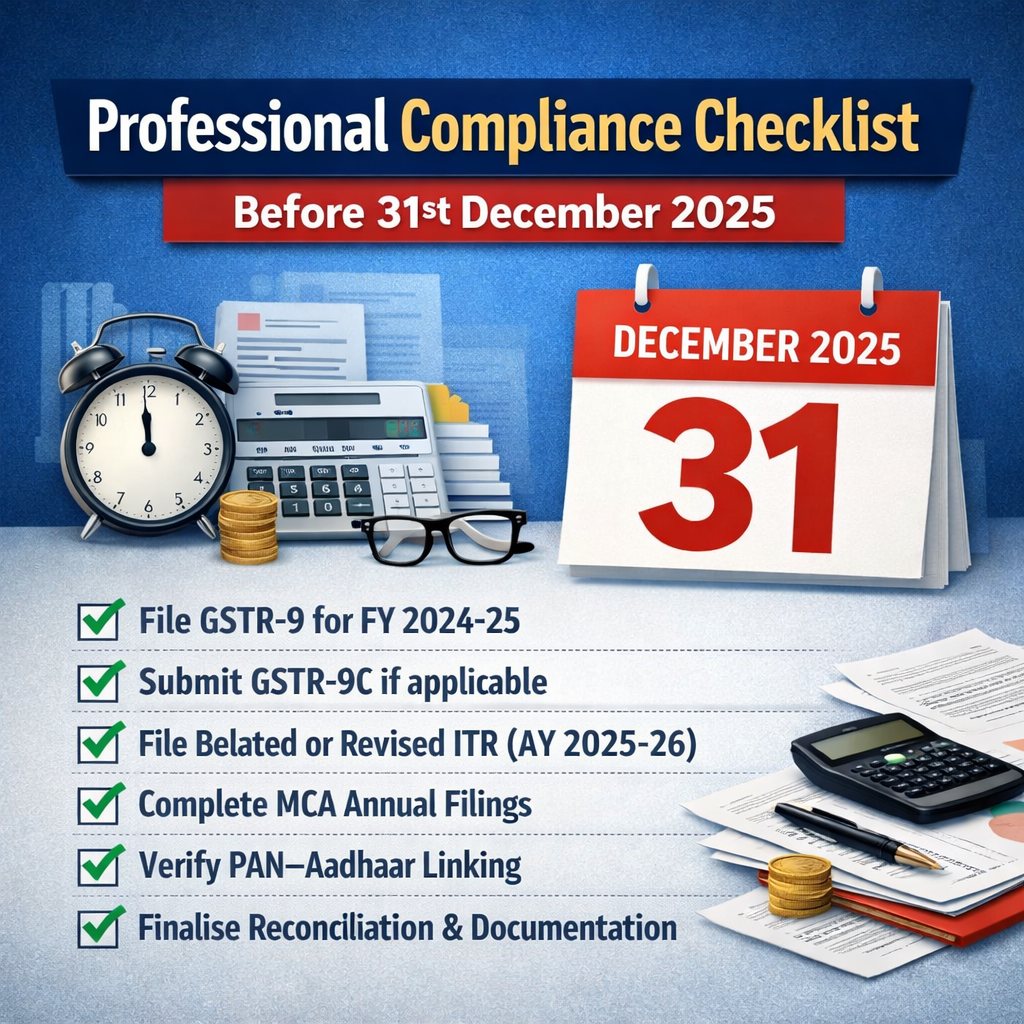

1. GSTR-9 / GSTR-9C Due Date Expired – Late Fees Triggered

The last date to file GSTR-9 and GSTR-9C for FY 2024-25 is 31 December 2025.

From 1 January 2026, these returns can still be filed, but mandatory late fees will apply based on turnover slabs.

GSTR-9 Late Fee Structure (Applicable from FY 2022-23 onwards)

| Annual Turnover | Late Fee per Day (CGST + SGST) | Maximum Late Fee |

|---|---|---|

| Up to ₹5 crore | ₹50 (₹25 + ₹25) | 0.04% of turnover |

| ₹5 crore – ₹20 crore | ₹100 (₹50 + ₹50) | 0.04% of turnover |

| Above ₹20 crore | ₹200 (₹100 + ₹100) | 0.05% of turnover |

Important Points:

-

Late fees continue to accumulate until the return is filed

-

No automatic waiver is available after the due date

-

GSTR-9C cannot be filed unless GSTR-9 is first filed

-

Late fee for GSTR-9C is ₹200 per day, capped at 0.05% of turnover

2. Belated and Revised ITR Filing Window Closes on 31 December 2025

For FY 2024-25 (AY 2025-26):

-

Belated Return under Section 139(4)

-

Revised Return under Section 139(5)

👉 Both are permitted only up to 31 December 2025.

From 1 January 2026, taxpayers will no longer be allowed to file either a belated or revised return for this financial year.

3. Updated Return Remains the Only Option – At a High Cost

Post 31 December 2025, the only return filing option available is the Updated Return under Section 139(8A).

Key Rules for Updated Returns

-

Can be filed up to 4 years from the end of the relevant assessment year

-

Allowed only in cases of:

-

Omitted income

-

Incorrect claims of exemptions, deductions, or losses

-

-

Refunds cannot be claimed

-

Losses cannot be carried forward

-

Additional tax payment is mandatory

📌 Updated returns are meant for tax recovery, not routine corrections.

4. PAN Becomes Inoperative If Aadhaar Is Not Linked

Failure to link PAN with Aadhaar results in the PAN becoming inoperative, leading to serious consequences.

Impact of Inoperative PAN

-

Income Tax Return cannot be filed

-

Tax refunds will not be issued

-

TDS will be deducted at higher rates

-

Certain banking transactions may be restricted

-

PAN becomes invalid for GST, investments, loans, and other financial compliance

5. GSTR-3B Filing to Be Blocked Due to ITC Restrictions from 1 January 2026

Starting with returns filed for January 2026 onwards, the GST portal will restrict GSTR-3B filing in certain ITC-related mismatch situations.

ITC Reclaim Ledger Validation

The amount of ITC reclaimed in Table 4(D)(1) must not exceed:

-

Closing balance of the ITC Reclaim Ledger, plus

-

ITC reversed in Table 4(B)(2) during the current tax period

Reverse Charge (RCM) Ledger Validation

ITC claimed under RCM in Table 4A(2) / 4A(3) must not exceed:

-

RCM tax paid and reported in Table 3.1(d), plus

-

Available balance in the RCM Ledger

❌ Any negative balance in the ITC or RCM ledger will automatically block GSTR-3B filing.

6. Non-Submission of Bank Details Will Trigger GST Registration Suspension

As per Rule 10A of the CGST Rules, furnishing bank account details is mandatory:

-

Within 30 days of GST registration, or

-

Before filing GSTR-1 or IFF, whichever occurs first

Consequences of Non-Compliance

-

GST registration will be system-suspended

-

Taxpayer will be unable to file returns

-

E-way bill generation will be blocked

-

Suspension remains until bank details are updated

7. GST Returns Older Than Three Years Become Non-Fileable

A critical but frequently overlooked provision:

👉 GST returns pending for more than 3 years become time-barred and cannot be filed.

This restriction applies to:

-

GSTR-1

-

GSTR-3B

-

GSTR-4

-

GSTR-5, 6, 7, 8, and 9

📌 Once a return becomes time-barred:

-

Related ITC is permanently forfeited

-

Annual return reconciliation becomes impossible

-

Departmental notices and demand proceedings may follow

8. Reassess Aggregate Annual Turnover (AATO) – GST Registration May Be Required

At the beginning of a new financial cycle, businesses should recalculate their Aggregate Annual Turnover (AATO).

GST registration becomes mandatory if AATO exceeds:

-

₹20 lakh (₹10 lakh for special category states), or

-

₹40 lakh for goods suppliers, subject to prescribed conditions

Failure to register can result in:

-

Tax demand along with interest

-

Monetary penalties

-

Denial of ITC to customers, affecting business credibility

9. Pay Advance Tax by 15 March to Avoid Interest Liability

Where total tax liability exceeds ₹10,000, payment of advance tax is compulsory.

-

Final instalment due: 15 March (100% of tax liability)

Non-payment or short payment may attract:

-

Interest under Sections 234B and 234C

-

Additional tax cost even if the ITR is filed within the due date

10. Regular Monitoring of Income Tax Portal Is Essential

Taxpayers must frequently review communications available on the Income Tax Portal, including:

-

E-proceedings and notices

-

Intimations under Section 143(1)

-

Defective return alerts

-

Refund adjustments

-

AIS/TIS mismatch communications

Ignoring portal notices may lead to:

-

Best judgment assessments

-

Withholding of refunds

-

Penalty and prosecution proceedings

-