Budget 2026 Income Tax Slab Rates for FY 2026-27 | AY 2027-28

Income Tax Rates as per Budget 2026 – FY 2026-27 (AY 2027-28)

No Change in Old Tax Regime Slab Rates

Union Budget 2026 has not made any changes to the income tax slab rates under the normal (old) tax regime. The slab structure applicable for FY 2026-27 continues to remain identical to FY 2025-26 for individuals, HUFs, companies, firms, and other assessees.

However, the new tax regime under Section 115BAC continues to apply with the revised slab rates introduced earlier, along with an enhanced rebate under Section 87A, making it the default regime for individuals.

1. Income Tax Rates – Individuals, HUF, AOP, BOI & AJP

(Old / Normal Tax Regime)

1.1 Individuals (Below 60 Years)

| Net Income | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

✔ Rates unchanged for AY 2026-27 and AY 2025-26

1.2 Resident Senior Citizens (60–79 Years)

| Net Income | Tax Rate |

|---|---|

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

1.3 Resident Super Senior Citizens (80 Years & Above)

| Net Income | Tax Rate |

|---|---|

| Up to ₹5,00,000 | Nil |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

1.4 HUF / AOP / BOI / Artificial Juridical Person

| Net Income | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

2. Surcharge – Individuals, HUF, AOP & BOI

| Total Income | Surcharge |

|---|---|

| ₹50 lakh – ₹1 crore | 10% |

| ₹1 crore – ₹2 crore | 15% |

| ₹2 crore – ₹5 crore | 25% |

| Above ₹5 crore | 37% |

Important Clarifications

-

Higher surcharge not applicable on:

-

Dividend income

-

Capital gains under Sections 111A, 112, 112A & 115AD

-

-

Surcharge on such income capped at 15%

-

Marginal relief available at each surcharge slab

3. Health & Education Cess

-

Levied at 4% on income tax plus surcharge

-

Not applicable to specified funds under Section 10(4D) (in notified cases)

4. Rebate under Section 87A – Old Regime

-

Available to resident individuals

-

Total income up to ₹5,00,000

-

Maximum rebate: ₹12,500

-

Result: Nil tax liability

5. Alternate Minimum Tax (AMT)

-

Applicable where regular tax is less than 18.5% of adjusted total income

-

AMT rate for IFSC units earning foreign exchange income: 9%

6. New Tax Regime – Section 115BAC

(Default from AY 2024-25)

6.1 Slab Rates – AY 2026-27

| Total Income | Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

6.2 Section 87A Rebate – New Regime

-

Available up to ₹12,00,000 income

-

Maximum rebate: ₹60,000

-

Marginal relief available

-

AMT not applicable under the new regime

7. Partnership Firms & LLPs

-

Flat tax rate: 30%

-

Surcharge: 12% if income exceeds ₹1 crore

-

Cess: 4%

-

AMT: 18.5% (9% for IFSC units)

8. Local Authorities

-

Tax rate: 30%

-

Surcharge, cess, and AMT same as partnership firms

9. Domestic Companies – Tax Rates

| Category | Tax Rate |

|---|---|

| Turnover ≤ ₹400 crore (FY 2023-24) | 25% |

| Other domestic companies | 30% |

Special Tax Regimes

-

Section 115BAA: 22%

-

Section 115BAB (Manufacturing): 15%

-

Surcharge: Flat 10%

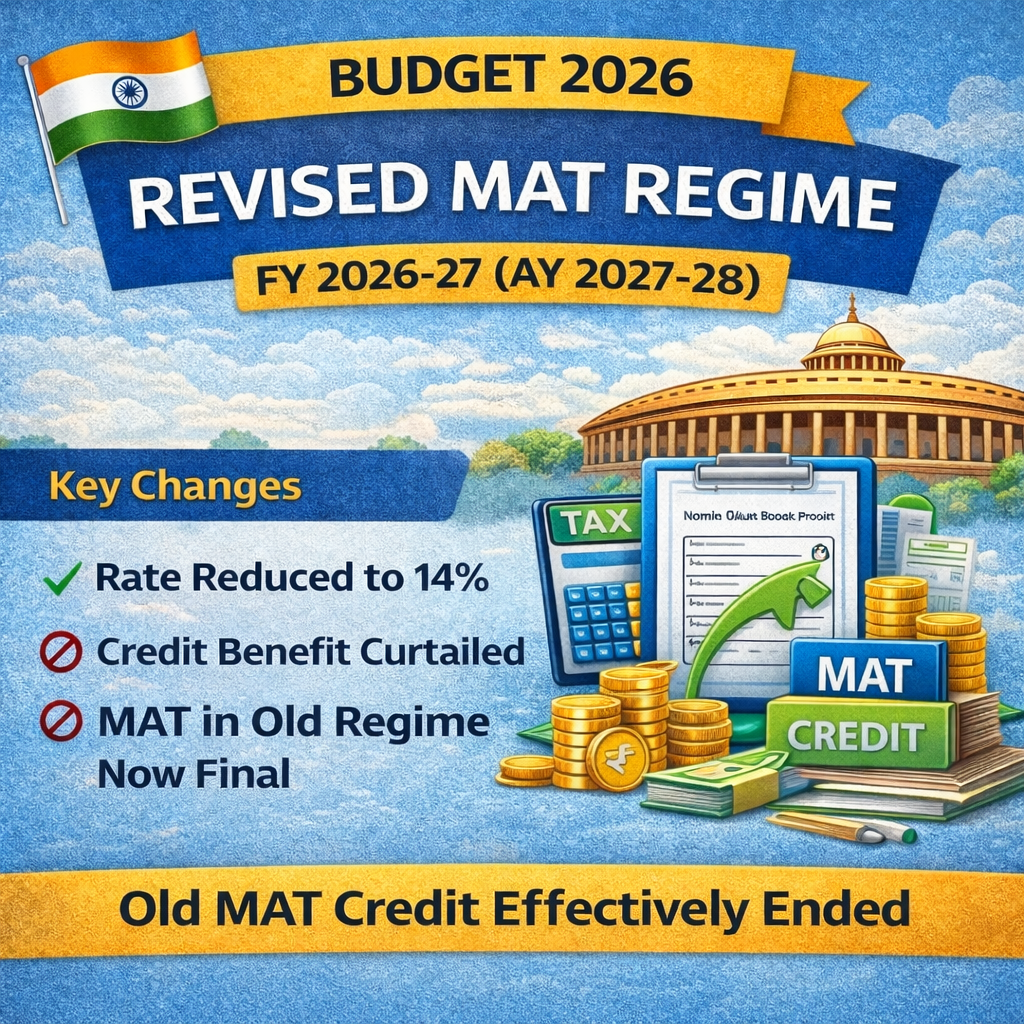

🔴 Major MAT Changes Introduced in Budget 2026

(Applicable from FY 2026-27 / AY 2027-28)

Key Reforms in Minimum Alternate Tax

(A) Reduction in MAT Rate

-

MAT rate reduced from 15% to 14%

-

Applicable to all companies except IFSC units

-

Surcharge and cess continue as applicable

(B) MAT to Become Final Tax under Old Regime

-

MAT paid under old regime will be treated as final tax

-

No fresh MAT credit allowed going forward

(C) Restriction on MAT Credit Set-off

-

Domestic Companies (New Regime):

-

MAT credit set-off limited to 25% of total tax liability

-

-

Foreign Companies:

-

Set-off allowed only to the extent normal tax exceeds MAT

-

10. Foreign Companies

| Nature of Income | Tax Rate |

|---|---|

| Royalty / FTS (old agreements) | 50% |

| Other income | 35% |

-

Surcharge: 2% / 5%

-

Cess: 4%

-

MAT applicable unless exempted

11. Co-operative Societies

Normal Rates

| Income | Tax Rate |

|---|---|

| Up to ₹10,000 | 10% |

| ₹10,001 – ₹20,000 | 20% |

| Above ₹20,000 | 30% |

Optional Regimes

-

Section 115BAD: 22%

-

Section 115BAE (Manufacturing): 15%

-

AMT not applicable once opted