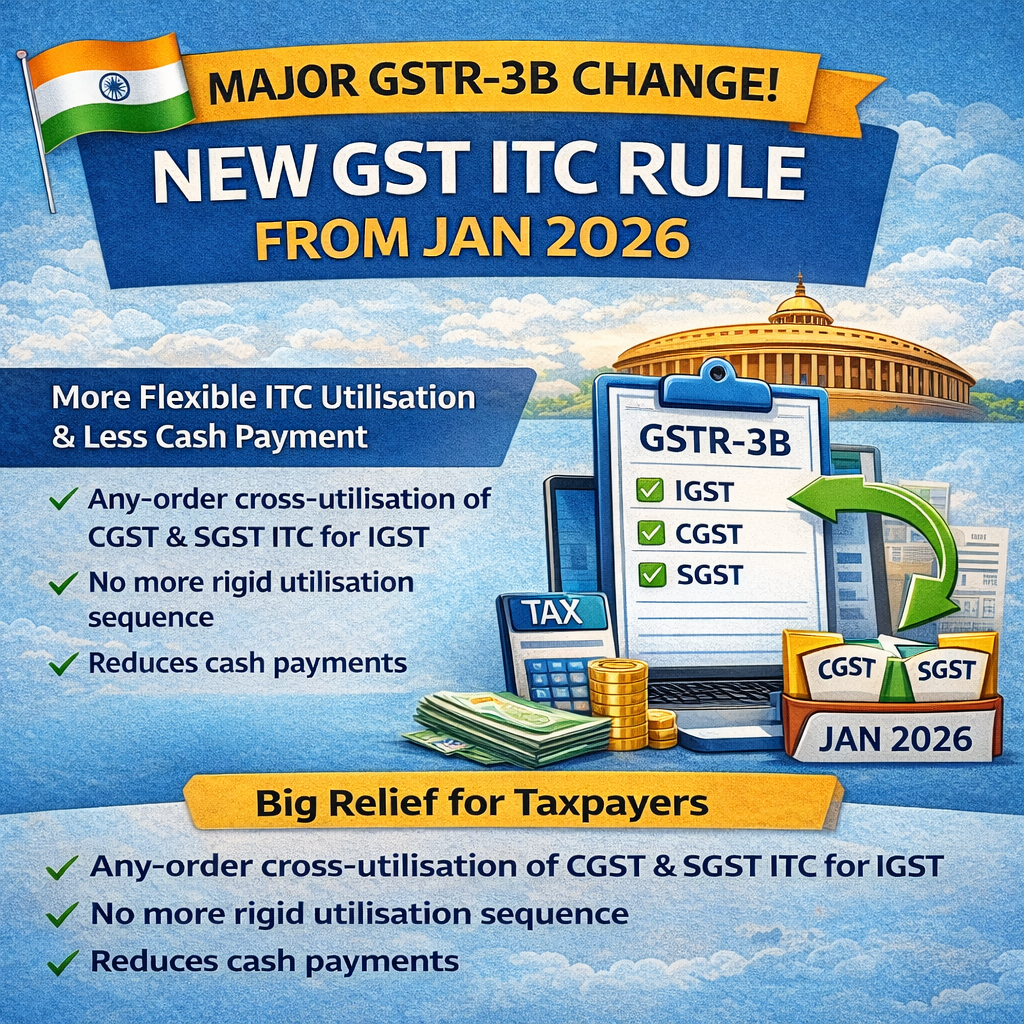

GSTR-3B Changes from Feb 2026: New GST ITC Rules Bring Relief to Taxpayers

To reduce taxpayer hardship, the GST Portal will roll out a major change in ITC utilisation from the January 2026 return period, relaxing the rigid utilisation sequence followed earlier.

1. Earlier ITC Set-Off Rule – Compliance Challenge

Statutory Position (Earlier Framework)

Under the earlier GST law and portal system, Input Tax Credit utilisation was subject to a strict and compulsory sequence:

-

IGST ITC was required to be utilised first:

-

Against IGST liability

-

Then against CGST liability

-

Then against SGST liability

-

-

CGST ITC could be utilised only:

-

Against CGST liability

-

Then against IGST liability

-

-

SGST ITC could be utilised only:

-

Against SGST liability

-

Then against IGST liability

-

❌ Direct cross-utilisation between CGST and SGST was not permitted.

Practical Difficulty for Taxpayers

Because of this rigid utilisation order, taxpayers often had to make cash payments, even when sufficient ITC was available under a different tax head. This resulted in blocked credits and avoidable cash outflow.

Illustration – Earlier Rule (Before January 2026)

Output Tax Liability

-

IGST: ₹1,00,000

-

CGST: ₹40,000

-

SGST: ₹40,000

Available ITC

-

IGST ITC: ₹1,00,000

-

CGST ITC: ₹50,000

-

SGST ITC: ₹50,000

Utilisation as per Earlier Rules

-

IGST ITC of ₹1,00,000 adjusted fully against IGST liability

-

CGST liability of ₹40,000 paid using CGST ITC

-

SGST liability of ₹40,000 paid using SGST ITC

✔ In this scenario, no hardship arose.

Problem Scenario Under Earlier Rules

-

Output IGST Liability: ₹80,000

-

Available ITC:

-

CGST ITC: ₹60,000

-

SGST ITC: ₹20,000

-

Under the old system:

-

CGST ITC could not be used to pay SGST

-

SGST ITC could not be used to pay CGST

➡ Result:

Despite total ITC being sufficient, cash payment became unavoidable due to utilisation restrictions. This was a common and recurring compliance issue.

2. New ITC Utilisation Rule – Effective from January 2026

What Has Changed?

🔹 System-level modification in Table 6.1 of GSTR-3B

From the January 2026 tax period onwards, once IGST ITC is fully exhausted, the GST Portal will allow utilisation of CGST and SGST ITC for payment of IGST liability in any sequence.

📌 This flexibility is enabled through the GST Portal system, without changing the basic statutory framework.

3. Salient Features of the New Rule

-

Applicable only after full utilisation of IGST ITC

-

CGST and SGST ITC can be used in any order

-

Cross-utilisation permitted only for IGST liability

-

Implemented through automated portal logic in GSTR-3B

-

Reduces cash outflow and accumulation of idle ITC

4. Illustration – New Rule (From January 2026)

Output IGST Liability: ₹80,000

Available ITC

-

IGST ITC: Nil

-

CGST ITC: ₹60,000

-

SGST ITC: ₹20,000

Utilisation under New Rule

-

CGST ITC utilised: ₹60,000

-

SGST ITC utilised: ₹20,000

➡ IGST liability fully discharged through ITC, with no cash payment

✔ Earlier: Cash payment was mandatory

✔ Now: Entire liability settled via ITC

5. Practical Impact on Taxpayers

✅ Significant Relief

-

Eliminates unnecessary cash payments

-

Prevents ITC pile-up under a single tax head

-

Improves liquidity and working capital efficiency

✅ Easier Compliance

-

System-driven utilisation suggestions

-

Reduced chances of manual errors

-

More logical and business-friendly ITC usage

6. Important Points to Remember

-

Direct cross-utilisation between CGST and SGST is still not allowed

-

Flexibility is permitted only for IGST liability

-

Applicable prospectively from January 2026

-

Taxpayers should analyse ITC balances before filing GSTR-3B

Practical impact:

Practical impact: