IMS to Auto-Populate Import Details in GSTR-2B Starting November 2025

The Invoice Management System (IMS) — a key technological reform under GST — was launched on the GST portal starting with the October 2024 tax period.

It enables taxpayers to view, monitor, and act on invoices uploaded by their suppliers through GSTR-1 / 1A / IFF, promoting greater transparency and facilitating accurate Input Tax Credit (ITC) reconciliation.

Building on this digital advancement, the GSTN has now expanded IMS to also capture “Import of Goods” details, providing taxpayers with a unified platform to manage both domestic and import transactions seamlessly.

🌍 New Addition: Import of Goods Integrated into IMS

The IMS Dashboard on the GST portal now features a dedicated section called “Import of Goods.”

This update links Bill of Entry (BoE) data — submitted by importers to Customs during goods import — directly with the IMS, allowing taxpayers to view, verify, and reconcile import details effortlessly within the same platform.

The enhancement will be effective from the October 2025 tax period, enabling smoother integration of Customs and GST data for improved compliance and accuracy.

🔍 Highlights of the Enhanced IMS Functionality

1️⃣ Auto-Fetch of Import Information

The GST portal will now automatically pull Bill of Entry (BoE) data directly from the ICEGATE Customs system, capturing all goods imported by the taxpayer.

This includes:

-

Imports originating from outside India, and

-

Supplies received from Special Economic Zones (SEZs).

2️⃣ New User Controls for Import Entries

Taxpayers can now review each BoE record and mark it as Accepted, Rejected, or Pending, similar to how supplier invoices are handled in IMS.

These actions will help ensure that Input Tax Credit (ITC) on IGST paid for imports is reflected accurately in their records.

3️⃣ Deemed Acceptance Mechanism

If a taxpayer doesn’t take any action on an import entry before the GSTR-2B generation date, it will automatically be treated as “deemed accepted.”

This avoids disruption in ITC flow due to oversight or delayed action.

4️⃣ Auto-Sync with GSTR-2B

Once actions are finalized, the GSTR-2B statement will be auto-generated on the 14th of the following month, following the regular timeline.

As a result, taxpayers will now get a consolidated view of both domestic and import-related transactions within a single GSTR-2B summary.

🧾 Example: Import Data Integration in Action

Consider TechNova Instruments Ltd., a Delhi-based company importing precision sensors from Germany in November 2025.

When the shipment lands, TechNova files a Bill of Entry (BoE) through the ICEGATE Customs system.

Within a short time, the same BoE details — including IGST paid, port of import, and invoice number — automatically appear in the company’s IMS dashboard under the “Import of Goods” tab on the GST portal.

TechNova can then:

-

✅ Approve the entry if all information matches its internal purchase records.

-

❌ Decline the entry if it belongs to another importer or contains discrepancies.

-

⏳ Mark Pending to verify the shipment details later.

If no action is taken before 14th December 2025, the system will auto-confirm the entry, ensuring the IGST credit appears in GSTR-2B for November 2025.

📈 Benefits of Import Data Integration in IMS

The inclusion of import data within the Invoice Management System (IMS) marks a major leap forward for taxpayers managing both domestic and international transactions.

✅ Key Advantages:

-

📊 Unified View: Access both domestic purchase invoices and import Bills of Entry (BoEs) from a single dashboard.

-

🔍 Error-Free Matching: Eliminates discrepancies between GST and Customs data.

-

💰 Accurate ITC Tracking: Ensures seamless reflection of IGST paid on imports in GSTR-2B.

-

⚙️ Simplified Reconciliation: Minimizes manual effort, reducing human error and compliance delays.

-

🌐 Enhanced Transparency: Strengthens cross-border compliance and promotes trust in tax data accuracy.

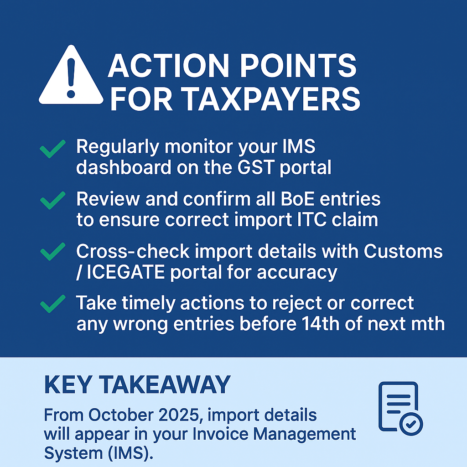

⚠️ Key Takeaways for Taxpayers

-

🗓️ Effective Date: The new IMS import feature comes into force from the October 2025 tax period.

-

📋 Regular Monitoring: Taxpayers should frequently review their IMS dashboard to verify newly fetched Bill of Entry (BoE) records.

-

🚫 Deemed Acceptance Rule: If no action is taken on a BoE record before the GSTR-2B generation date, it will be auto-marked as accepted — so ensure any incorrect import entries are rejected in time.

-

🧾 Unified GSTR-2B: From now on, GSTR-2B will automatically include import data along with domestic invoices, generated on the 14th of every month.

-

🌐 SEZ Imports Included: This functionality also covers imports from Special Economic Zones (SEZs).

📆 Implementation Schedule

| Particulars | Implementation Month | Key Action |

|---|---|---|

| IMS introduced on GST Portal | October 2024 | Supplier invoices made available for taxpayer action |

| Import of Goods section added | October 2025 | Bills of Entry (BoE) data integrated into IMS |

| Deemed Acceptance rule applies | November 2025 onwards | Unactioned BoE records automatically marked as accepted |

| Unified GSTR-2B generation | From 14th November 2025 | GSTR-2B will reflect both domestic and import transactions |

📢 Essential Steps for Taxpayers

✅ Keep a close watch on your IMS dashboard each month for new import entries.

✅ Verify every Bill of Entry (BoE) appearing in the system to ensure your import-related ITC is accurate.

✅ Match import details with records available on the ICEGATE portal to confirm correctness.

✅ Take timely action — approve, dispute, or hold entries well before the 14th of the following month to avoid automatic acceptance.

✅ Treat the IMS as a single compliance hub for managing both domestic and import purchase data effectively.

🎯 Core Insight

From October 2025 onward, import transactions will seamlessly appear in the Invoice Management System (IMS) on the GST portal.

Each import record can be reviewed, confirmed, or flagged by the taxpayer, and the system will then auto-generate GSTR-2B on the 14th of the next month, combining both domestic and import information in a single, reconciled summary.