Filing of GSTR-9 and GSTR-9C for FY 2024-25 is now available on the GST Portal

✅ Recent Update

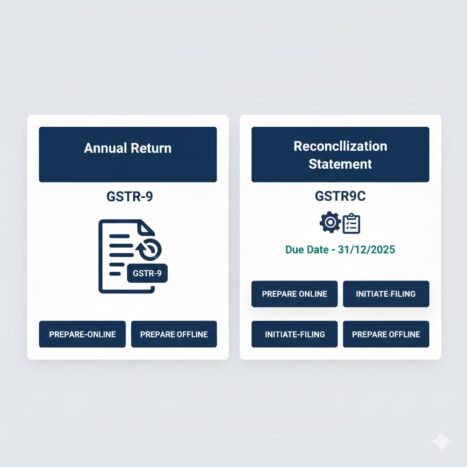

GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) for FY 2024-25 are now available on the GST Portal.

Taxpayers can now file their annual returns and reconciliation statements in line with the updated formats and instructions, which reflect the recent amendments in GST rules and legislation.

The deadline to file both forms, unless an extension is announced, is 31st December 2025.

🆕 GSTR-9 & 9C: Key Modifications for FY 2024-25

The revised forms include multiple updates based on recent amendments and notifications. Let’s go through them step by step:

1️⃣ Enhanced ITC Reporting and Reversal Requirements

- Taxpayers are now required to submit more detailed information regarding Input Tax Credit (ITC).

- Reversals must be reported separately as per Rules 37, 37A, 38, 42, and 43.

This is intended to enhance reconciliation accuracy and ensure proper tracking of ITC.

👉 Tip: Before submitting, thoroughly check reversal entries, reclaimed credits, and auto-filled data.

2️⃣ New Fields for Import and Transitional Credit Reporting

- New fields have been introduced for reporting import-related ITC and transitional credits.

- This promotes greater transparency for businesses importing goods or transferring credits from previous tax regimes.

👉 Tip: Match your import details with the ICEGATE system and verify accuracy before submission.

3️⃣ Auto-Population of Data and Mismatch Handling

- The updated forms automatically fetch data from GSTR-1, GSTR-3B, and GSTR-2B.

Several fields will be prefilled to minimize manual mistakes.

However, taxpayers should carefully verify and reconcile all details, as discrepancies may trigger future audits.

👉 Tip: Ensure sales, ITC, and outward supply figures are fully reconciled before filing.

4️⃣Late Fee and Interest Reporting Standardized

- The revised guidelines mandate clear disclosure of any late fees or interest due under Section 47(2).

- All filing delays must be reported transparently in the prescribed form.

👉 Tip: Do not use back-dated entries — ensure the actual delay period and corresponding charges are reported accurately.

5️⃣New Instructions with Relevant Rule References

- The instructions for both GSTR-9 and GSTR-9C have been revised to enhance clarity and ease of understanding.

- Table references and compliance logic have been simplified to minimize errors in interpretation

👉 Tip: Review the updated instruction sheet before beginning the filing process.